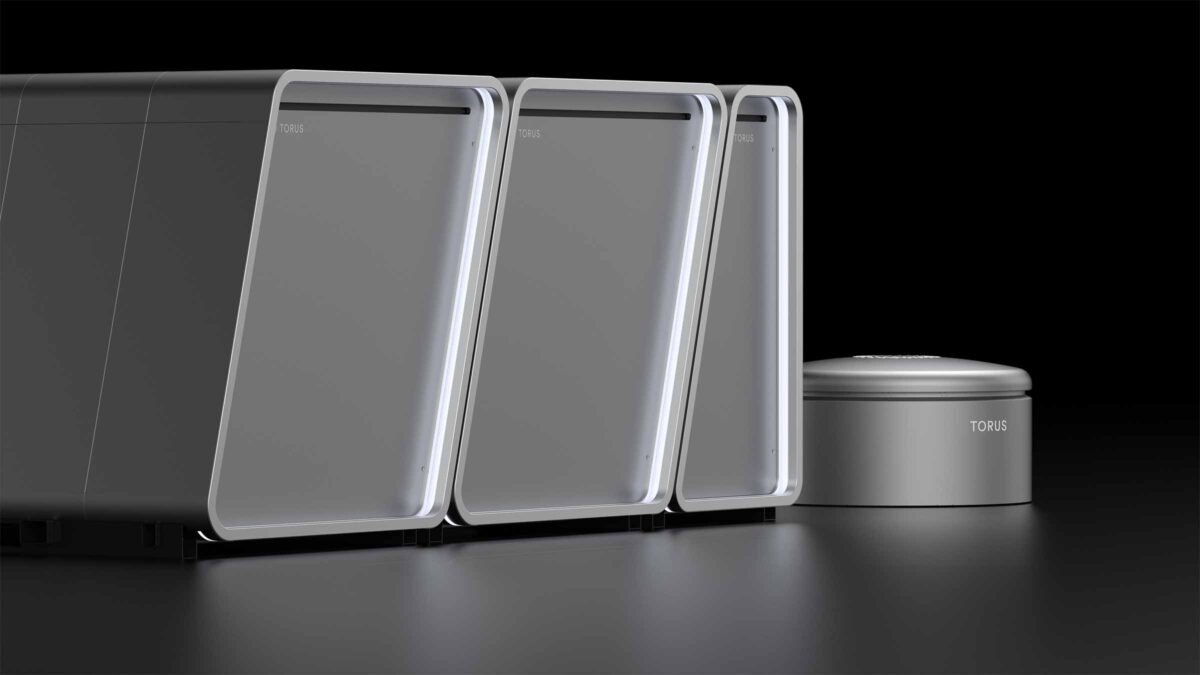

The Utah-primarily primarily based mostly flywheel specialist and vitality management firm has lately unveiled its fat-stack suite of business vitality storage, management, and security products.

Portray: Torus

From ESS News

US-primarily primarily based mostly storage specialist Torus has lately showcased its recent vitality storage and cybersecurity solutions. The product lineup, which modified into presented at the 47G Zero Gravity Summit in Utah in gradual October, capitalizes on the firm’s vertically constructed-in flywheel technology, which objects it apart in the commercial vitality storage market.

The product, known as Torus Nova Toddle, is an superior Flywheel Energy Storage System (FESS) offering like a flash response capabilities for grid balance and backup vitality. Now not like aged batteries, which rely on chemical reactions, the Torus Nova Toddle shops vitality mechanically by spinning a rotor at high speeds. This get permits it to tell high vitality density, twice the lifespan of aged batteries, and a response time of lower than 250 milliseconds.

Another machine the firm presented is Torus Nova Pulse. Right here’s a Battery Energy Storage System (BESS) particularly designed for long-period vitality storage and grid give a steal to, scalable from four- to eight-hour cost and discharge capabilities.

To proceed studying, please consult with our ESS News online page.

This narrate material is good by copyright and have to not reused. So as for you to cooperate with us and must reuse about a of our narrate material, please contact: editors@pv-magazine.com.