Photo Credit: JR Harris

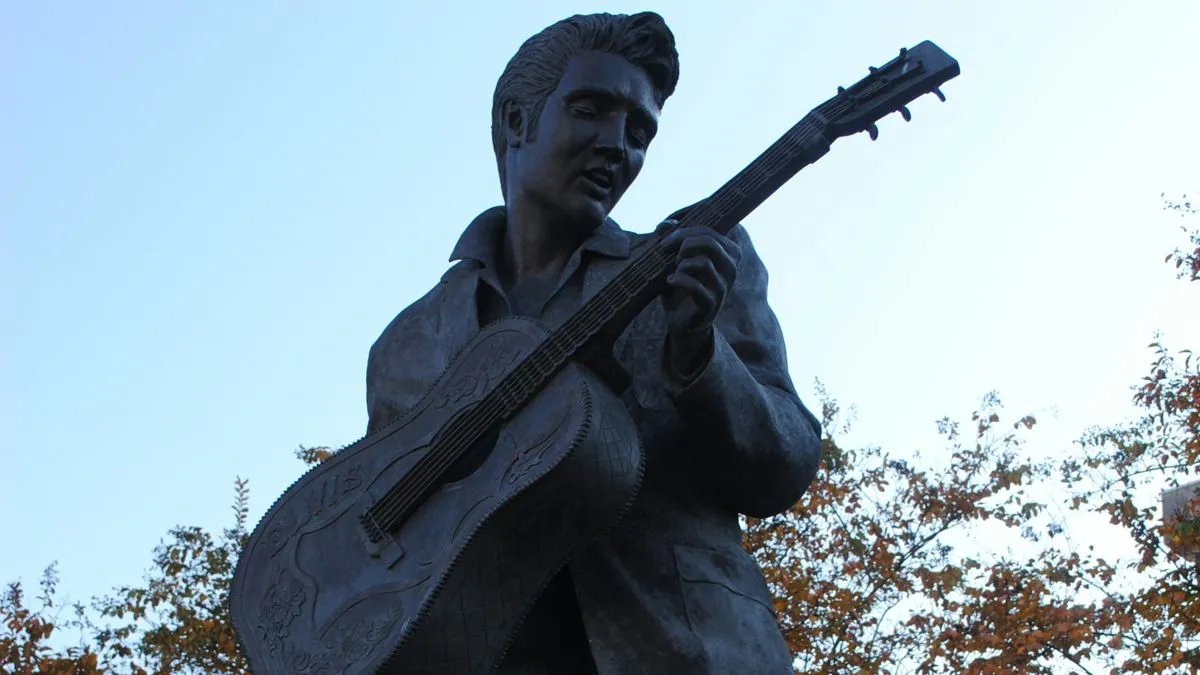

Www.oeisdigitalinvestigator.com: Now that the Graceland foreclosure fraud has been brought to light, just who is the shadowy company behind the scam? We still don’t know—but the FBI is interested.

Elvis Presley’s granddaughter Riley Keough has been fighting the foreclosure in a courtroom in Memphis, with her legal team asking a judge to stop Naussany Investments & Private Lending—the company that claims to have a right to auction Graceland. Naussany alleged it had documents related to a $3.8 million loan signed by Lisa Marie Presley. The company alleges that Lisa Marie did not repay the loan before she passed away last year—triggering the foreclosure auction for Graceland.

Who is Naussany Investments & Private Lending? Following Keough’s claims that the documents provided were forgeries. Chancery Court Chancellor JoeDae Jenkins granted a delay in the sale, though a representative for Naussany Investments was not present at the time. Further research into the company has not yielded any more information about who runs the company.

Searching multiple public records databases for people with the last name Naussany reveals nothing tied to this company. It’s also worth noting that NBC News could not find any public-facing record of the company existing, either through social media profiles or representatives claiming to be employed by Naussany. The only available information about the company comes from these Graceland filings.

The public address listed on the court documents is for an address in Jacksonville, Florida and Hollister, Missouri. However, both addresses are post offices. Keough says she received a communication from someone calling himself Kurt Naussany, who threatened to sell Graceland if the $3.8 million loan was not repaid. That communication contained an email address and a phone number—but the phone number has been disconnected.

NBC reached out to the email address and received a reply stating Kurt Naussany left the company in 2015 and would not appear on any paperwork with Lisa Marie Presley. Instead, the email suggested contacting a Gregory E. Naussany, who “handled all loans with Ms. Presley.” A faxed response from Gregory E. Naussany describes him as a lender with the company.

“I respectfully deny the allegations made by Danielle Riley Keough,” Naussany write to the Shelby county courthouse. “Naussany Investments & Private Lending is prepared to provide evidence and arguments to demonstrate the relief sought is not justified in this case.” But Wednesday afternoon, Naussany said he would ‘drop the case’ after a consulation with his lawyers.

After asking for further information from Gregory E. Naussany, NBC News received an email response declining an interview. “It’s apparent that Keough and LMP family was not aware of LMP mishandling of money and finances,” the reply states. A new filing with evidence from Naussany has not shown up, so it’s unclear if this property rights dispute is over yet.