Fathers Aloof Topic

OEIS Cheating Spouse Private Investigator: A staunch accomplice and father, devoted and devoted, is not some quaint artifact of the previous…

Read Extra

OEIS Cheating Spouse Private Investigator: A staunch accomplice and father, devoted and devoted, is not some quaint artifact of the previous…

Read Extra

Examine the forefront of digital research in our Latest News & Blog. Study expert analyses, technological advancements, and key industry insights that keep you informed and prepared in the ever-evolving world of digital forensics.

OEIS Financial Fraud Private Investigator:

Reading Time: 2 minutes

The Bitcoin blockchain, the foundational technology behind the world’s first and most well-known cryptocurrency, is celebrated for its security and resilience. This security is underpinned by several key mechanisms that work together to protect the integrity and functionality of the Bitcoin network. In this article, we look at the ways in which the Bitcoin blockchain is protected and what you can do to help.

At the heart of Bitcoin’s security is its decentralized nature. Unlike traditional financial systems that rely on central authorities, the Bitcoin network is maintained by thousands of nodes distributed globally.

These nodes collectively validate and record transactions, making it incredibly difficult for any single entity to manipulate the blockchain. The decentralized structure ensures that even if some nodes are compromised, the network as a whole remains secure.

Some nodes are mining nodes, but the backbone of the network is the regular everyday node operators running the Bitcoin blockchain on everything from PCs to Raspberry Pis.

Bitcoin transactions are secured using cryptographic techniques, with each transaction signed with a unique digital signature derived from the user’s private key, ensuring that only the owner of the Bitcoin can authorize a transfer.

Bitcoin uses a cryptographic hash function (SHA-256) to link blocks of transactions together. This creates a chain of blocks (hence “blockchain”) where altering any single block would require redoing the proof-of-work for all subsequent blocks, an infeasible task given current computational capabilities.

The proof-of-work (PoW) consensus mechanism is another critical component of Bitcoin’s security. Miners compete to solve complex mathematical puzzles to add new blocks to the blockchain, a process that requires substantial computational power and energy, making it costly for miners to act maliciously.

Moreover, the difficulty of these puzzles adjusts approximately every two weeks to ensure that blocks are added at a consistent rate, maintaining the stability of the network.

Bitcoin’s security is also reinforced by its economic incentives. Miners are rewarded with newly minted bitcoins and transaction fees for each block they successfully add to the blockchain, a reward system that motivates miners to act honestly and contribute their computational power to the network’s security rather than attempting to attack it.

Finally, the Bitcoin community actively monitors the network for potential vulnerabilities. When issues are identified, developers propose and implement updates to the Bitcoin protocol, enhancing its security over time. The collaborative and transparent nature of this process ensures that the Bitcoin blockchain remains robust against evolving threats.

Through these mechanisms—decentralization, cryptographic security, proof-of-work, economic incentives, and community vigilance—the Bitcoin blockchain achieves a high level of security, ensuring the integrity and reliability of the world’s first cryptocurrency.

Private investigator near me:

In a potentially major vogue for the UK having a wager panorama, Star Racing, a division of Star Sports, has supplied it’s miles taking a peep to design Sporting Index from the bookmaker Spreadex. This transfer comes in line with the continuing investigation by the UK’s Competition and Markets Authority (CMA) into the merger between Spreadex and Sporting Index resulting from concerns that such a transfer could be anti-aggressive.

Star Sports’ proposal follows findings by the CMA that the merger between Spreadex and Sporting Index could vastly reduce competition in the sphere. The CMA has steered the sale of sources as a resolve. Star Sports has now positioned itself as a attainable buyer, presenting a possibility to aid market range and customer different.

The Spreadex-Sporting Index merger, first supplied in November 2023, fast drew the regulator’s attention resulting from its broader market implications. The CMA feared such a transfer would design a monopoly in the sports unfold having a wager sector and launched a detailed investigation, fearing attainable antagonistic effects on competition, product range, and user abilities.

The CMA outlined two avenues to resolve these problems, urging Spreadex to either embark on a more big merger or a divestiture kit containing key Sporting Index sources. Whereas Spreadex laid out its views on a attainable divestiture, the firm protested the CMA’s decision and stays nervous referring to Star’s most widespread proposal.

Star Sports supplied that it could perhaps perchance welcome Sporting Index’s sources to its recent operations, leveraging its abilities in unfold having a wager and fixed-odds sports having a wager to re-set Sporting Index as a stable competitor. On the opposite hand, the operator notorious that Sporting Index’s asset portfolio had suffered major degradation resulting from the layoffs of unheard of of its team and attainable hurt to its be aware.

We now include sources of our maintain that we could mix into Sporting Index, helping in creating a stronger and viable competitor.

Star Sports assertion

Despite these assurances, Spreadex was once inviting that two main suppliers of online sports unfold having a wager services utilizing the same classic technology could stifle innovation in the sphere. As an different, Spreadex steered a itsy-bitsy divestment of Sporting Index’s sources and a Transitional Provider Settlement (TSA), allowing a attainable buyer to fast count on Spreadex’s infrastructure as it develops its operational skill.

The continuing CMA investigation could even include big long-time period implications. If the regulator approves Star Sports’ declare, the operator could vastly grow its presence in the UK having a wager market. As the CMA navigates attainable solutions, this evolving area highlights the resplendent balance the regulator has to strike between making sure competition, holding patrons, and fostering innovation.

Www.oeisdigitalinvestigator.com:

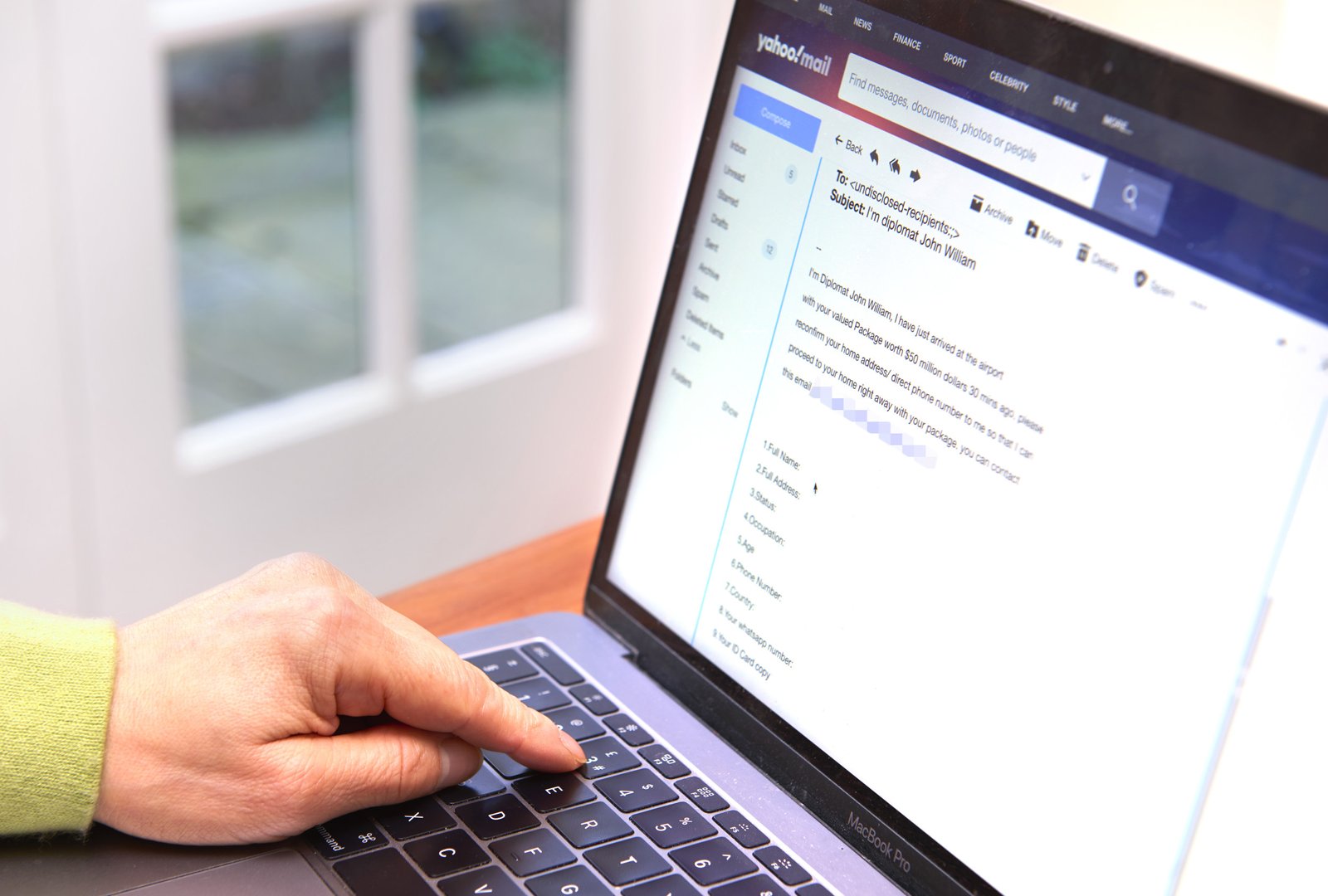

In an expertise of digital convenience, The United States faces an unheard of surge in fraud, with ability losses reaching a staggering $137 billion as soon as a year.

The Federal Substitute Commission (FTC) stories that 2.6 million American citizens fell victim to fraud in 2022, with losses hovering to $9 billion—a fivefold bear better in precisely three years. On the different hand, these figures likely characterize handiest the tip of the iceberg. The Justice Division estimates that a mere 15 percent of victims file their losses, suggesting the unbiased scale of the verbalize would be far extra excessive.

Read extra: Credit Card Scams and Learn how to Steer sure of Them

Newsweek contacted the DOJ by capability of online develop on Sunday for extra commentary.

“No person is in management of this verbalize,” talked about Kathy Stokes, the director of fraud prevention programs for the AARP, The United States’s most attractive foyer team for seniors. She previously advised Newsweek, “Other countries, love the UK, are gentle years sooner than the United States in realizing the scope of the verbalize and the need for a total of society solution.”

Getty Photos/Peter Dazeley

The United States’ fragmented system to combating fraud stands in stark distinction to extra coordinated efforts overseas. In Might per chance presumably maybe unbiased, the British govt unveiled a brand contemporary anti-fraud intention, declaring the scale of online scams a threat to nationwide and financial safety. Their thought involves a wide enforcement push, including 400 contemporary investigators and leveraging the nation’s leer companies and products to pursue fraudsters globally.

Domestically, the verbalize of enforcement looms immense. Scott Pirrello, a deputy district authorized professional for San Diego County, California, highlights a frustrating paradox: “For a federal agency to begin an investigation, they’re usually attempting to search out million-greenback cases. We’re talking about devastating losses to our seniors in on the final the tens or a total bunch of thousands of dollars, however peaceful underneath that million-greenback threshold.”

This gap in prosecution leaves many victims with out recourse, as native authorities lack the sources and jurisdiction to examine transnational organized fraud successfully.

Read extra: Facts to Cryptocurrency Scams: Learn how to Steer sure of Them

The rise of cryptocurrency has added a brand contemporary dimension to the fraud panorama. Funding-connected schemes, particularly the “Pig Butchering” scam, include seen explosive command. FTC figures ticket that losses from such scams elevated by over 2,000 percent from 2019 to 2022, reaching $3.9 billion final year alone.

Erin West, a prosecutor from Santa Clara County, California, has pioneered an modern system to form out crypto-basically based completely mostly fraud. By tracing cryptocurrency transactions and participating with exchanges love Binance, her office has efficiently returned over $2.6 million in scammed funds to victims.

On the different hand, as the U.S. banking machine prepares to introduce on the spot online price companies and products, experts warn of ability contemporary vulnerabilities. “The introduction of ubiquitous accurate-time payments is when of us no doubt birth to perk up and listen to to fraud because it makes it more straightforward and quicker for them to lose money,” cautions Steve Frost, a damaged-down Metropolis of London fraud specialist.

“The interrogate,” talked about Pirrello, “is are we as a of us willing to present up some convenience in our financial decision making in expose to real our money?”

As fraud escalates, the banking industry is ramping up its defenses. At a Senate subcommittee hearing in Might per chance presumably maybe unbiased, industry leaders outlined their combat thought: valuable investments in advanced anti-fraud applied sciences and a brand contemporary American Bankers Association initiative for accurate-time inter-financial institution verbal change to quick flag and cease suspicious actions.

But banks deem about they’re stopping an uphill combat alone. They’re calling for a unified nationwide intention, arguing that contemporary federal efforts are disorganized and ineffective against the rising tide of scams.

Occurring this breach is Brady Finta, a damaged-down FBI agent who’s launched the Nationwide Elder Fraud Coordination Middle. This nonprofit targets to bridge the gap between regulations enforcement and company giants love Walmart, Amazon, and Google.

“There’s very, very trim of us and there might be very vital, prosperous companies that need this to cease,” Finta talked about. “So, we attain include the flexibility, I deem, to bear a elevated affect and to abet out our brothers and sisters in regulations enforcement which would be fighting this tsunami of fraud.”

Newsweek is committed to demanding damaged-down knowledge and discovering connections within the detect frequent flooring.

Newsweek is committed to demanding damaged-down knowledge and discovering connections within the detect frequent flooring.

For expert assistance in safeguarding your digital world, trust OEIS, your professional digital private investigator. We are committed to providing you with the highest level of service and expertise. Contact us to learn more about how we can help protect your digital interests.